Medicare Part D

Medicare Part D Prescription Drug Coverage

Beginning in 2006, insurance coverage for prescription medications was made available for people with Medicare. Medicare Part D Prescription Drug plans often require payment of a plan premium, and some plans require an annual deductible to be met before the plan begins to pay for prescription drugs. Copayments are then required, with generic medications normally featuring lower copays as compared to name brand medications. Each Medicare Part D Prescription Drug plan features a Formulary – a listing of all prescription medications that are covered by the plan. Medicare Part D Prescription Drug plans are run by private insurance companies that follow rules set by Medicare.

Key Facts

- Available to anyone who is enrolled in Medicare (Part A or Part B or Parts A & B)

- Provided by private insurance companies

- Monthly premiums vary by plan

- You are only allowed to have one Medicare Part D Prescription Drug plan at a time.

- You must live in the service area of the Medicare Part D Prescription Drug plan you want to join.

- If you don’t enroll when you are first eligible you will pay a penalty of 1% for every month that you did not enroll.

- Just like Medicare Part B, premiums could be subject to an income based premium surcharge.

- You can get “Extra Help” which is a low-income subsidy (LIS) Medicare program that helps people with limited income and resources pay for Medicare Part D Prescription Drug costs.

Important Restrictions and Limitations

- Prior Authorization: The plan you enroll in may require prior authorization for certain medications. Your prescriber may need to show that the medication is medically necessary for the plan to cover it.

- Formulary: Each Medicare Part D Prescription Drug plan has its own list of covered drugs. The list of prescription drugs covered by your Medicare Part D Prescription Drug can add or remove medications it covers every year. Prescription drugs are placed into different “tiers” representing different costs:

- Tier 1 – preferred generic

- Tier 2 – non-preferred generic

- Tier 3 – preferred brand name

- Tier 4 – non-preferred brand name

- Tier 5 – Specialty tier

- Quantity Limits: The plan you enroll in only covers a specific amount and type of prescription drug over a specific timeframe.

- Step Therapy: Your Medicare Part D Prescription Drug plan may require you first try certain less expensive prescription drugs that have been proven for most people with your condition before you can move up a “step” to a more expensive prescription drug. If you have already tried the similar, less expensive prescription drugs and they didn’t work, your prescriber can contact the plan to ask for an exception. If approved your plan will cover the step-therapy prescription drug.

- Safety Checks: Prior to filling your prescriptions, your Medicare Part D Prescription Drug plan works with pharmacies to perform additional safety checks, like checking for prescription drug interactions, incorrect dosages, and unsafe amounts of certain drugs (like opioids and benzodiazepines).

- Prescription Drug Management Programs: Some Medicare Part D Prescription Drug plans have a program in place to help you use these opioids and benzodiazepines safely. If you get opioids from multiple doctors or pharmacies, your plan will contact the doctors who prescribed these medications to make sure they are medically necessary and that you’re using them appropriately.

How Medicare Part D Coverage Works

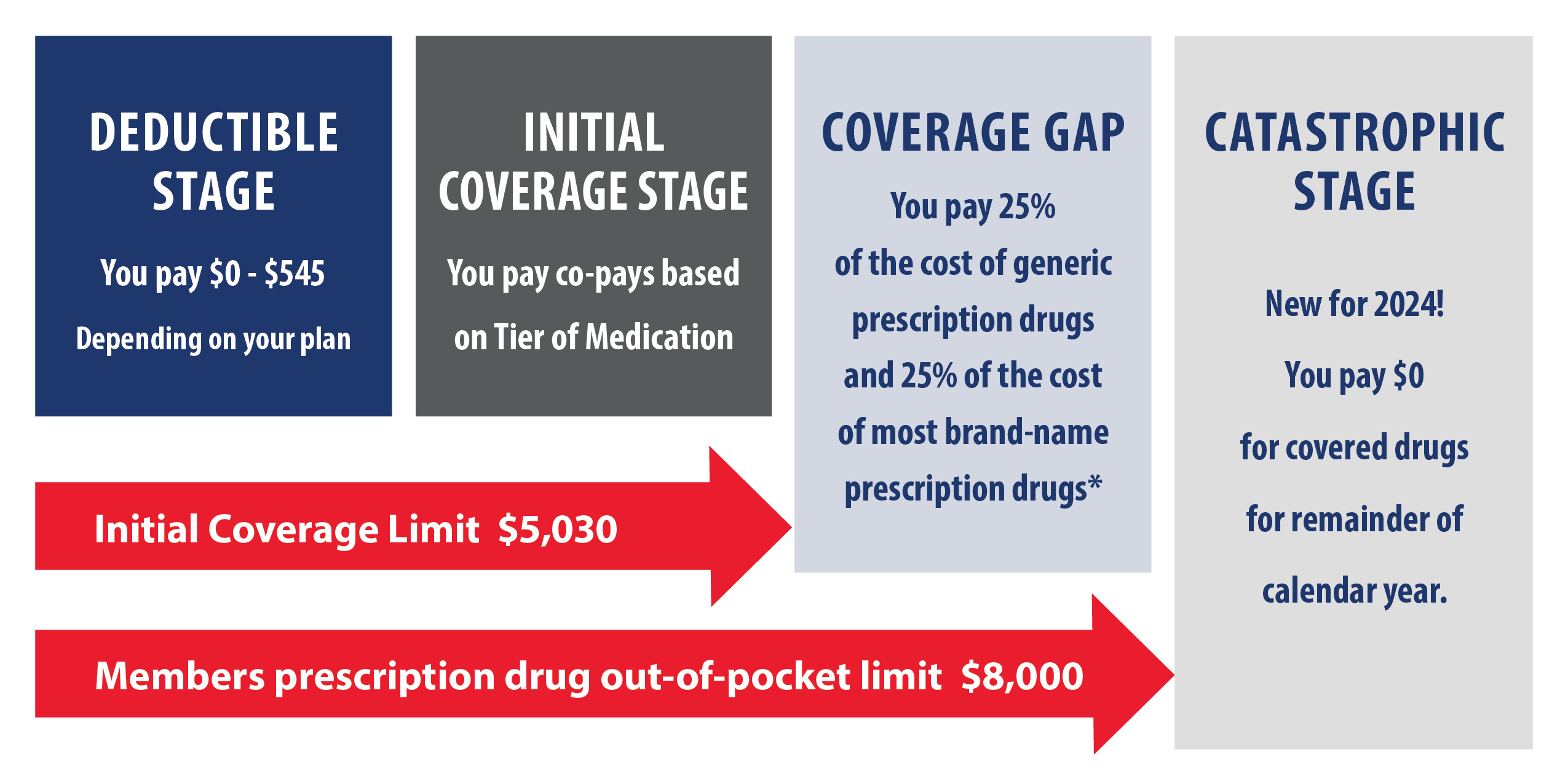

*Click image to enlarge

*Total out-of-pocket costs are the amounts paid by you in the first two stages plus any applicable drug manufacturer discounts applied in the Coverage Gap Stage.

Monthly Premium

Most Medicare Part D Prescription Drug plans charge a monthly fee that varies by plan. You pay this in addition to the Medicare Part B premium. If you’re in a Medicare Advantage plan or a Medicare Cost plan that includes Prescription Drug coverage, the monthly premium may include an amount for prescription drug coverage. If you have a higher income, you might pay more for your Medicare Part D Prescription Drug coverage. If your income is above a certain limit ($97,000 if you file individually or $194,000 if you’re married and file jointly), you’ll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”- see more here: www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/monthly-premium-for-drug-plans). You’ll also have to pay this extra amount if you’re in a Medicare Advantage plan that includes drug coverage.

Initial Deductible

This is the amount you must pay before your Medicare Part D Prescription Drug plan begins to pay its share of your covered prescription drugs. Deductibles vary between Prescription Drug plans. No plan may have a deductible more than $545 in 2024. Some plans don’t have a deductible.

Copayments

These are the amounts you pay for your covered prescriptions after the deductible (if the plan has one). You pay your share and your Prescription Drug plan pays its share for covered prescriptions. If you pay a copayment, you pay a set amount (like $10) for all drugs on a tier. You may pay a lower copayment for generic prescription drugs than brand-name prescription drugs. Copayments continue until you reach the 2024 Initial Coverage Limit of $5,030.

Coinsurance

After reaching the end of your Initial Coverage Limit, your Medicare Part D Prescription Drug plan enters a “Coverage Gap” (a.k.a. the ‘Donut Hole’) where you pay coinsurance. If you pay coinsurance, you pay a percentage of the cost (25%) of the drug, and these amounts may vary throughout the year due to changes in the prescription drug’s total cost. After you and your plan reach $8,000 out-of-pocket limit for the year (including the $5,030), you will move out of the donut hole and into catastrophic coverage (for more on costs in the coverage gap go here: www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/costs-in-the-coverage-gap).

Catastrophic Coverage

Once you’ve met your plan’s out-of-pocket cost requirements for the year, you automatically get “catastrophic coverage.” With catastrophic coverage, you only pay a reduced coinsurance amount or copayment for covered prescription drugs for the rest of the year.

Medicare Part D Prescription Drug plan costs will vary depending on:

- Your prescriptions and whether they’re on your plan’s formulary (list of covered prescription drugs) and depending on what “tier” the drug is in.

- Which phase of your prescription drug benefit that you’re in (some examples include whether or not you met your deductible, if you’re in the catastrophic coverage phase, etc.).

- The plan you choose. Remember, plan coverage and costs can change each year.

- Which pharmacy you use (whether it offers preferred or standard cost sharing, is out-of-network, or is mail order). Your out-of-pocket prescription drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less.

- Whether or not you get Extra Help paying your Prescription Drug costs.

Comparing Medicare Part D Prescription Drug Plan Options

There are 2 ways to get Medicare Part D Prescription Drug coverage:

1. Medicare Part D Prescription Drug plans. These plans (sometimes called “PDPs”) add drug coverage to Original Medicare, Medicare Supplement (Medigap), some Medicare Cost plans, some Medicare Private Fee-for-Service (PFFS) plans, and Medicare Medical Savings Account (MSA) plans. You must have Medicare Part A and/or Medicare Part B to join a Medicare Part D Prescription Drug plan.

2. Medicare Advantage plans or other Medicare health plans that offer Medicare Part D Prescription Drug coverage. You get all of your Medicare Part A, Medicare Part B, and Medicare Part D Prescription Drug coverage, through these plans. Medicare Advantage plans with Medicare Part D Prescription Drug coverage are sometimes called “MA-PDs.” Remember, you must have Medicare Part A and Medicare Part B to join a Medicare Advantage plan, and not all of these plans offer prescription drug coverage.

When can I join, switch, or drop a Medicare Part D Prescription Drug plan?

- When you first become eligible for Medicare, you can join during your Initial Enrollment Period.

- If you get Medicare Part A and Medicare Part B for the first time during the General Enrollment Period, you can also join a Medicare Part D Prescription Drug plan from April 1– June 30. Your coverage will start on July 1.

- You can join, switch, or drop a Medicare Part D Prescription Drug plan during the Annual Enrollment Period between October 15– December 7 each year. Your changes will take effect on January 1 of the following year, as long as the plan receives your request before December 7.

- If you’re enrolled in a Medicare Advantage (MA) plan, you can join, switch, or drop a MA-PD plan during the Medicare Advantage Open Enrollment Period, between January 1–March 31 each year.

- If you qualify for a Special Enrollment Period. Special Enrollment Periods are times when you can join, switch, or drop your Medicare Part D Prescription Drug coverage if you meet certain requirements. Generally, you must stay enrolled in your plan for the entire year, but you may be able to change your coverage mid-year if you qualify for a Special Enrollment Period when certain events happen in your life. Check with your plan carrier for more information.

- Read more about Important Dates here.

Tips for Comparing Plans

It is most important to verify that your current medications are included in the plan’s formulary before applying for coverage. Here are more tips when evaluating Medicare Part D Prescription Drug plans:

- Make a list of all your medications to including: the Name of the drug, the Dosage, and the Frequency of use. This information is necessary when comparing Medicare Part D Prescription Drug plans. When making your list of medications don’t forget creams, ointments, eye drops, and nasal sprays that are prescribed by your physician.

- Review the formulary for your chosen Medicare Part D Prescription Drug plan. If you do not see a specific name brand medication included, you will be required to purchase the medication on your own. Name brand medications can be very expensive, so be careful.

- Look at the different copayment “Tiers” featured by the plan. Remember that these copays are for a 30-day supply only, so you will need to multiply the copay by 12 in order to determine the annual out-of-pocket expense for a prescription.

- You should also confirm your preferred pharmacy is contracted with any Prescription Drug plans of interest.

- If you are taking a name brand medication and a generic equivalent is available, check with your physician to see if changing to the generic is advisable. If so, it can save you considerable money over the course of a year.

- If you are considering the benefits of joining a Medicare Advantage plan, keep in mind that many Medicare Advantage plans require you to join their Prescription Drug plan (this applies to Medicare Advantage HMOs, PPOs, and Special Needs plans). However, this requirement does not apply to Medicare Supplement plans, as you must purchase a Prescription Drug plan separately.

- Not sure if your prescription drugs are covered? The Medicare website’s plan finder (www.medicare.gov/drug-coverage-part-d/what-medicare-part-d-drug-plans-cover) has an extremely useful tool where you can enter your prescription drug information and compare Prescription Drug plans available in your area.

What’s the Medicare Part D Prescription Drug late enrollment penalty?

The late enrollment penalty is an amount that’s permanently added to your Medicare Part D Prescription Drug premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there’s a period of 63 or more days in a row when you don’t have Medicare Part D Prescription Drug coverage or other creditable prescription drug coverage. You’ll generally have to pay the penalty for as long as you have Medicare Part D Prescription Drug coverage. Note: If you get Extra Help, you don’t pay a late enrollment penalty.

3 ways to avoid paying a penalty:

- Join a Medicare Part D Prescription Drug plan when you’re first eligible. Even if you don’t take prescriptions now, you should consider joining a Prescription Drug plan or a Medicare Advantage plan that offers prescription drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums.

- Enroll in a Prescription Drug plan if you lose other creditable coverage. Creditable prescription drug coverage could include prescription drug coverage from a current or former employer or union, TRICARE, Indian Health Service, the Department of Veterans Affairs, or individual health insurance coverage. Your plan must tell you each year if your prescription drug coverage is creditable coverage. If you go 63 days or more in a row without a Prescription Drug plan or other creditable prescription drug coverage, you may have to pay a penalty if you join later.

- Keep records showing when you had creditable drug coverage and tell your plan if they ask about it. If you don’t tell the plan about your creditable prescription drug coverage, you may have to pay a penalty for as long as you have Prescription Drug coverage.

How much more will I pay?

The cost of the late enrollment penalty depends on how long you didn’t have creditable prescription drug coverage. Currently, the late enrollment penalty is calculated by multiplying 1% of the “national base beneficiary premium” ($34.70 in 2024) by the number of full, uncovered months that you were eligible but didn’t join a Prescription Drug plan and went without other creditable prescription drug coverage. The final amount is rounded to the nearest $.10 and added to your monthly premium. Since the “national base beneficiary premium” may increase each year, the penalty amount may also increase each year. After you join a Prescription Drug plan, the plan will tell you if you owe a penalty and what your premium will be.

For Example: If you are without creditable prescription drug coverage for 24 months, your penalty would be 24% (1% for each of the 24 months) of $34.70 (the national base beneficiary premium for 2024), which is $10.06. Rounded to the nearest $0.10, the late enrollment penalty will be $10.10 in addition to your plan’s monthly premium in 2024. You’ll continue to pay a penalty for as long as you have Prescription Drug coverage, and the amount may go up each year (read more here: www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage/part-d-late-enrollment-penalty).